Twinn: better decisions today for a sustainable tomorrow

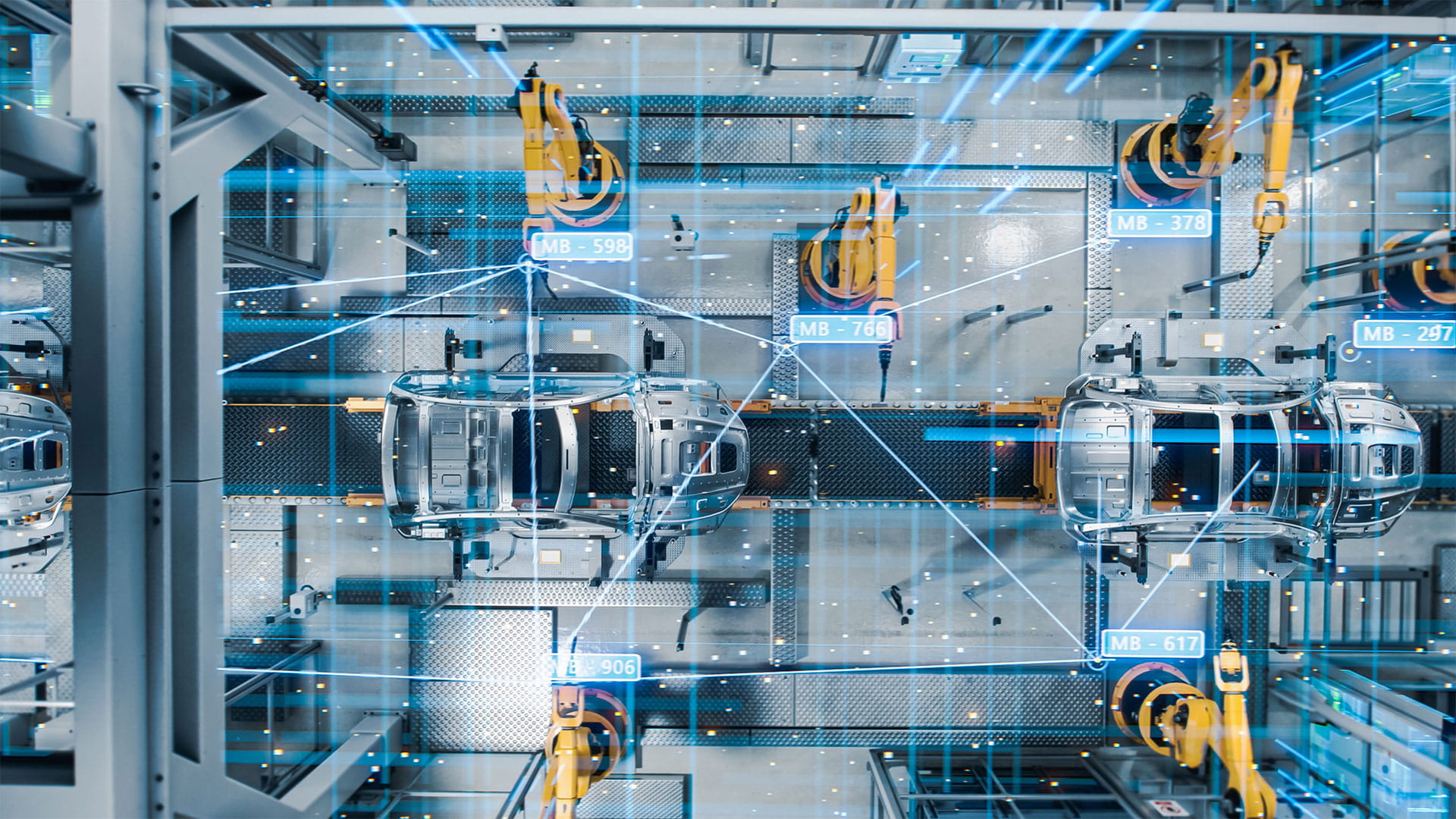

Twinn provides digital solutions for decision intelligence that help you connect and understand the dynamics across your organisation's physical and digital worlds. Manage your risks and make better informed strategic and operational decisions with the support of our deep domain expertise, software and data.

Discover our suites

Turn complexity into clarity

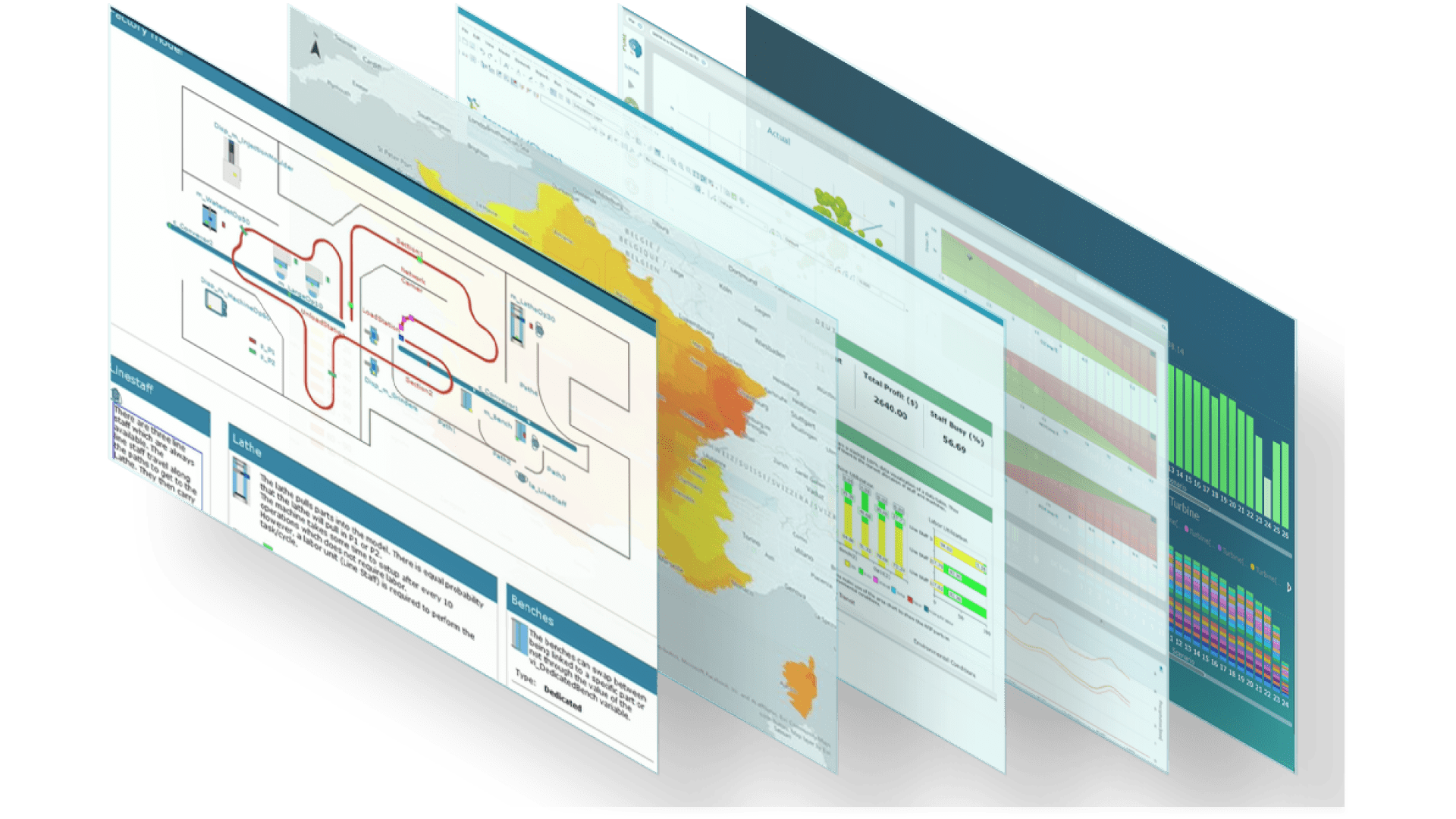

Consider the strategic, risk management and operational questions that impact business resilience, sustainability and digital transformation. Answering these questions requires the right data, the ability to model dynamic processes, a way of connecting your physical and digital worlds – and access to insightful analytics to make decisions at speed. That's where Twinn comes in.Our digital solutions

Twinn at a glance

Twinn is part of Royal HaskoningDHV, drawing on 6,000 experts and more than 140 years of innovation heritage. We have the agility of a tech company, the skills of an engineering powerhouse and a track record of providing intelligent solutions to complex problems. Our digital solutions provide actionable insights that help you become more resilient, sustainable and innovative.

Get a free climate risk report

Twinn’s climate risk assessment helps you visualise physical risks and identify hazards as they develop – so you can understand, predict and mitigate their impact before they cause issues.

Do you want to know more or have a question?

Contact our experts!